An Expert Level candidate asked some questions related to sample exam Item Set #15; the vignette is described below:

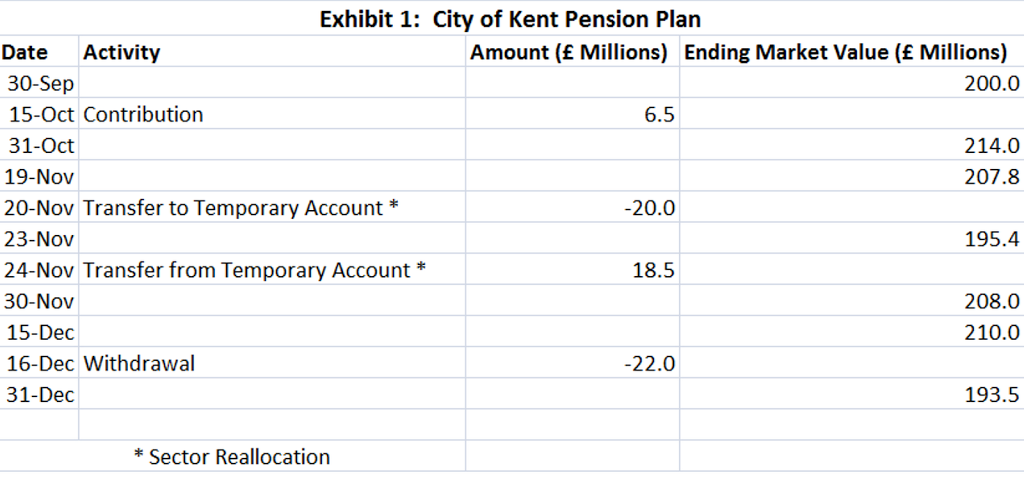

White Oaks Investment Management, a firm that claims to comply with the GIPS standards, manages an equity portfolio for the City of Kent’s pension plan. Patrick Lor, head of performance reporting, is reviewing Kent’s fourth-quarter portfolio activity and returns.

White Oaks uses the modified Dietz methodology to calculate monthly returns. The firm revalues portfolios when large external cash flows occur, and transfers cash and/or securities to or from temporary new accounts when there are significant cash flows. For the composite that includes the City of Kent’s portfolio, both large and significant cash flows are defined as cash flows that exceed ten percent of the portfolio’s market value.

The City of Kent contributed £6.5 million to its portfolio on 15 October and withdrew £22 million on 16 December.

The portfolio manager reallocated £20 million from the energy and gold sectors to the financials and health care sectors. The trading activity began on 20 November and was completed on 24 November.

Lor reviews Exhibit 1, which was prepared by a member of his staff.

In particular, the candidate’s question was with respect to the second question in this Item Set:

(193.5 – 210 + 22) / (210 – 22), which assumes start of day timing for cash flows.