My friend, occasional sparring partner, Statpro chairman, and recently inducted member to the Performance & Risk Measurement Hall of Fame, Carl Bacon, CIPM and I recently engaged in a brief exchange via blog messages regarding the presence of residuals in geometric attribution. He insists that they’re not there, while I believe they are. While I could very well be wrong about this, I’ll share with you the facts as I know them.

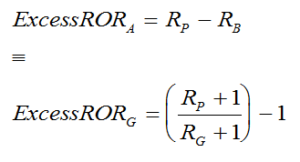

First, as you may know, “geometric” doesn’t mean geometric linking in the context of attribution: it has to do with the way excess return is expressed. Excess return is not derived from subtraction (Portfolio Return minus Benchmark Return) as we do with the arithmetic approach but through division (Portfolio Return + 1, divided by Benchmark Return + 1), then minus one. We can say that these formulas are equivalent:

Therefore, when employing a geometric model, we reconcile to this differently formed value.

As a rule, Carl uses fractions to represent return differences, which arithmetic shows a subtractions. This doesn’t hold for weight differences, however, which he shows in the same manner as arithmetic (i.e., as subtraction). This is different than what Jose Menchero, PhD, CFA does (he uses fractions for both weights and returns).

Any arithmetic model can be expressed geometrically. Carl’s approach is a geometric attribution representation of the Brinson, Fachler model. Let’s look at the three effects and how they differ. But first, we’ll look at HOW THEY SHOULD work, if we could construct our geometric model directly from arithmetic.

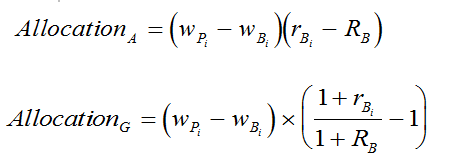

Geometric Attribution: Allocation Effect

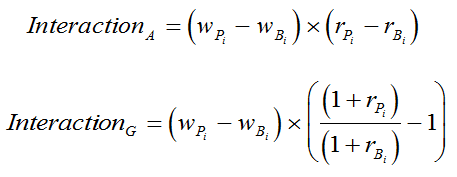

Here we find the two approaches, the original Brinson, Fachler arithmetic view, and the equivalent for geometric:

We see how the weight factors are identical; and, as promised, the subtraction of returns from the arithmetic model is represented as division in geometric.

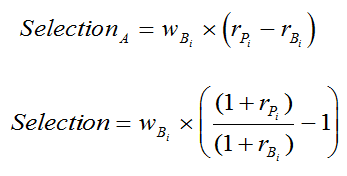

Geometric Attribution: Selection Effect

We of course have an option with selection: whether to use the benchmark weight, and also represent the interaction effect, or use portfolio weight, which eliminates an interaction term (selection then becomes selection plus interaction). Since I’m a fan of interaction, I’ll use benchmark weight:

Again, we see how our return differences in the original model are switched to a fraction in geometric.

Geometric Attribution: Interaction Effect

Because we used benchmark weight in selection, we’re obligated to have an interaction effect:

Because interaction is simply the difference in weights times the difference in returns, we can clearly see how Carl’s approach handles differences differently (great choice of wording on my part)! That is, weight differences are shown with subtraction, while return differences are a ratio.

This is all wonderful, except for one small detail:

The math doesn’t work. Sorry.

If you simply do as I’ve shown above, we don’t tie back to the overall geometrically derived excess return, which, of course, is our objective.

What to do, what to do?

Excuse me while I ponder this a moment …

I know, we’ll come up with a smoothing factor!

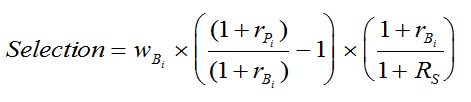

And that, dear reader, is exactly what Carl did. He applies it to the selection effect; his adjusted formula is as follows:

Notice the additional factor?

The same factor must be applied to the interaction effect, otherwise, the math doesn’t work out.

R(subS) is Carl’s “semi-notional return.”

There is nothing equivalent in the arithmetic model; it’s unique to this implementation of geometric.

Jose uses a very different (and more complex) approach.

Because this is kind of important, I’ll spell it out a bit more in this month’s newsletters.

BTW, it’s also something we cover in our Attribution Class, in case you’d like to learn more!

Any thoughts? Feel free to chime in.